Last Week in Bitcoin: Silent Prices, Loud Plumbing

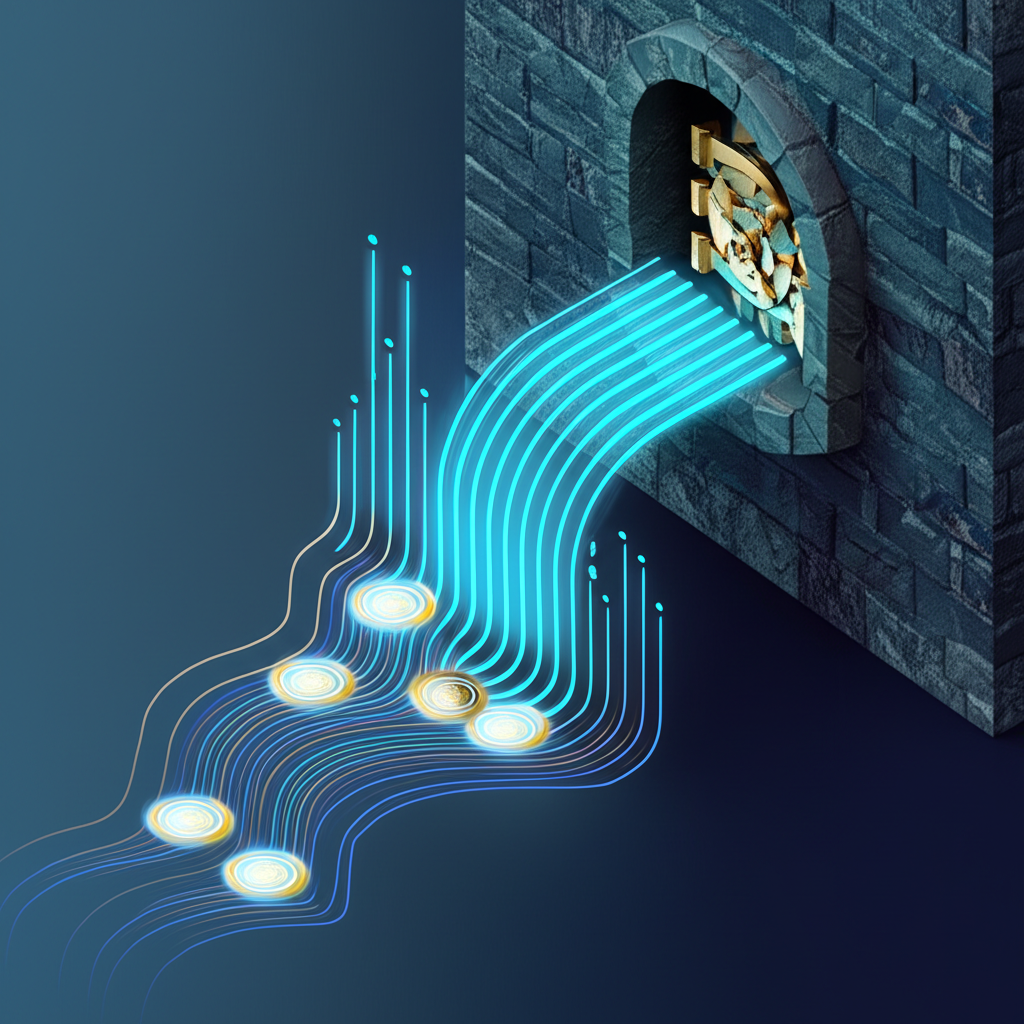

If one were to judge the state of the cryptocurrency market solely by price action this week, they might be forgiven for thinking the industry had taken an early holiday. Bitcoin has spent the last seven days tracing a flatline between $88,000 and $92,000, exhibiting the kind of volatility usually reserved for utility stocks. Yet, beneath this veneer of calm, the structural machinery of the market is undergoing its most significant renovation in years. While traders yawned at charts, regulators and bankers were busy laying the pipes that will connect digital assets to the deepest liquidity pools of traditional finance.

The Flatline

Bitcoin closes the week hovering near $89,050, effectively unchanged from seven days ago. Volume has tapered to between $50 billion and $65 billion daily, a decline consistent with consolidation fatigue. The asset failed to hold support above $94,000 earlier in the month and has since settled into a range that technical analysts politely describe as "compression" and impolitely describe as "watching paint dry."

However, there is a distinct milestone to note amidst the quiet: the network has officially crossed the 95% mined supply threshold. With less than 1.05 million BTC left to be issued over the next century, the scarcity narrative is no longer theoretical—it is mathematical reality tightening its grip on the order book.

The Institutional Plumbing Job

While price discovery paused, the integration of Bitcoin into the global financial stack accelerated.

1. Collateral, Finally

In a move that garnered far less attention than it deserved, the CFTC launched a pilot program allowing Bitcoin, Ethereum, and USDC to be used as collateral in U.S. derivatives markets. This is a subtle but seismic shift in capital efficiency. Previously, institutions had to liquidate crypto holdings into cash to post margin—a friction point that deterred long-term holding. By treating Bitcoin as valid collateral, the CFTC is effectively graduating the asset from a speculative bet to a functional balance sheet tool, akin to Treasuries or gold.

2. PNC and the "Real Thing"

PNC Bank, a top-10 U.S. lender, announced a partnership with Coinbase to offer direct Bitcoin trading and custody to private banking clients. Unlike the ETF craze, which offered exposure via a wrapper, this allows clients to hold the asset itself. This distinction matters: it signals that major banks are moving from merely selling tickets to the show to actually building the theater.

3. Future-Proofing

Addressing the perennial anxiety regarding quantum computing, researchers at Blockstream published a proposal for "hash-based signatures." While quantum threats remain distant, this preemptive cryptographic upgrade serves to silence one of the few remaining legitimate existential risks to the network’s long-term security.

Whale Watch: Movement Without Malice

On-chain alerts flashed red this week, though the panic proved largely performative. A massive transfer of 43,033 BTC ($3.9B) sparked fears of a sell-off, only to be identified as Twenty One (XXI) restructuring custody ahead of their NYSE listing. Similarly, a $205 million outflow from Antpool appears to be standard inventory management rather than a liquidation event. The "whales" are moving furniture, not leaving the house.

Looking Ahead

The market is currently characterized by a tension between bullish structural news and bearish macro correlations. Bitcoin remains tethered to the tech sector, which softened this week on AI earnings concerns, acting as a drag on crypto prices.

However, the technical indicators suggest this silence is temporary. Bollinger Bands are tightening to extremes that historically precede explosive volatility. Whether that expansion resolves upward toward the psychological $100,000 barrier or forces a re-test of lower support remains the question for next week. For now, the price is boring, but the plumbing is fascinating—and in finance, the plumbing usually dictates the future.